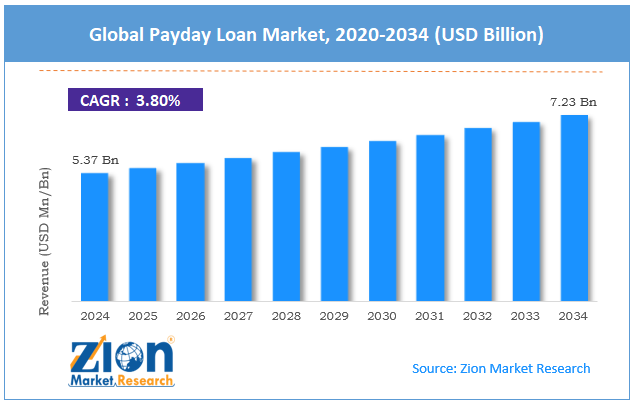

Payday Loan Market Size Will Attain USD 7.23 Billion by 2034 Growing at 3.80% CAGR - Exclusive Report by Zion Market Research

The global payday loan market size was valued at USD 5.37 billion in 2024 and is expected to surpass USD 7.23 billion by 2034, registering a CAGR of 3.80% during the forecast period (2025- 2034), as highlighted in a report published by Zion Market Research.

NEW YORK, USA, Aug. 27, 2025 (GLOBE NEWSWIRE) -- Zion Market Research has published a new research report titled “Payday Loan Market By Type (Storefront Payday Loans, Online Payday Loans), By Marital Status (Married, Single), By Customer Age (Less than 21, 21-30, 31-40, 41-50, More than 50), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034” in its research database.

“According to the latest research study, the global payday loan market size was valued at around USD 5.37 billion in 2024. The market is expected to grow at a CAGR of 3.80% and is anticipated to reach a value of USD 7.23 billion by 2034.”

Get a Free Sample PDF of this Research Report for more Insights - https://www.zionmarketresearch.com/sample/payday-loan-market

(A free sample of this report is available upon request; please get in touch with us for more information.)

Payday Loan Market Overview:

The payday loan offers short-term and high-interest credit, usually intended for borrowers requiring immediate cash before their upcoming paycheck. These loans are generally small in amount but carry higher interest rates than customary credit, making them overpriced if not promptly paid. The global payday loan market is poised for notable growth owing to the growing financial emergencies, the development of online lending platforms, and the rising number of underbanked and unbanked populations. Unexpected expenditures, such as utility payments, vehicle repairs, and medical bills, are driving consumers toward payday loans for quick cash. Several households lack emergency savings, resulting in surging dependency on these services. The speed and convenience of approval further propel this demand.

Report Scope:

| Report Attribute | Report Details |

| Market Size in 2024 | USD 5.37 Billion |

| Market Forecast in 2034 | USD 7.23 Billion |

| Growth Rate | CAGR of 3.80% |

| Base Year | 2024 |

| Forecast Years | 2025- 2034 |

| Key Companies Covered | Advance America, Check Into Cash, Speedy Cash, MoneyTree, Cash America International, Dollar Loan Center, LendUp, CashNetUSA, Check ‘n Go, PDL Loan, 247Moneybox, MyJar, QuickQuid, Ferratum Group, LendingBear, and others. |

| Segments Covered | By Type, By Marital Status, By Customer Age, and By Region |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

| Customization Scope | Avail customized purchase options to meet your exact research needs. |

Directly Purchase a Copy of the Report | Quick Delivery Available - https://www.zionmarketresearch.com/buynow/su/payday-loan-market

Key Insights from Primary Research

- As per the analysis, the payday loan market share is likely to grow at a CAGR of around 3.80% between 2025 and 2034.

- The payday loan market size was worth around $5.37 billion in 2024 and is estimated to hit approximately $7.23 billion by 2034. Due to a variety of driving factors, the market is predicted to rise at a significant rate.

- Based on type, the storefront payday loans segment is growing at a high rate and is projected to dominate the global market.

- On the basis of marital status, the single segment is projected to swipe the largest market share.

- In terms of customer age, the 21-30 segment is likely to grow at a significant rate over the forecast period.

- On the basis of region, North America is expected to dominate the global market during the forecast period.

Payday Loan Market: Growth Drivers

- How is digitization remarkably driving the global payday loan market?

The payday loan market’s inclination has reduced acquisition costs and increased geographic reach. Several new applications in different developed markets are now initiated on smartphones, with same-day funding and instant decisioning becoming table stakes. This UX parity with BNPL and fintech wallets preserves relevance among younger and mobile-first borrowers.

Alternative data, including bank transaction analytics, utility/telecom histories, and payroll/shift data histories, enables lenders to underwrite below the conventional FICO frontier. While outcomes differ by model quality, lenders report better risk sorting and higher approval rates when assimilating bank-connect data with income volatility metrics, which materially benefits short-term loans.

Browse the full “Payday Loan Market By Type (Storefront Payday Loans, Online Payday Loans), By Marital Status (Married, Single), By Customer Age (Less than 21, 21-30, 31-40, 41-50, More than 50), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034” Report at https://www.zionmarketresearch.com/report/payday-loan-market

Payday Loan Market: Segmentation

The global payday loan market is segmented based on type, marital status, customer age, and region.

Based on type, the global payday loan industry is divided into storefront payday loans and online payday loans. By type, the storefront payday loans segment accounted for a larger market share due to its mature presence in the rural and urban areas.

Based on marital status, the global payday loan market is segmented into married and single individuals. The single segment dominates the market, primarily due to their reliance on a single income source, which leaves them highly vulnerable financially.

Based on customer age, the global market is segmented into the following categories: less than 21, 21-30, 31-40, 41-50, and more than 50. The 21-30 segment holds a dominating share because of their entry-level incomes, limited savings, and high propensity for lifestyle-related spending.

Why does North America outperform other regions in the global payday loan market?

North America is projected to maintain its dominant position in the global payday loan market due to high demand driven by financial instability, developed lending ecosystems, and intense penetration of online payday lending. A significant share of the North American population lives paycheck-to-paycheck, creating robust demand for short-term credit. In the United States, nearly 61% of adults reported in 2023 that they could not manage a USD 1,000 emergency expense without borrowing. This financial vulnerability propels the payday loan sector as a quick solution for emergency needs. North America holds a sophisticated payday lending infrastructure, with abundant licensed and well-established online platforms. The United States alone has more than 20,000 payday loan outlets, promising easy accessibility.

Request For Customization on This Report as Per Your Requirements - https://www.zionmarketresearch.com/custom/9770

(We tailor your report to meet your specific research requirements. Inquire with our sales team about customising your report.)

Payday Loan Market: Competitive Landscape

The report contains qualitative and quantitative research on the global payday loan market, as well as detailed insights and development strategies employed by the leading competitors.

Some of the main players in the global payday loan market include;

- Advance America

- Check Into Cash

- Speedy Cash

- MoneyTree

- Cash America International

- Dollar Loan Center

- LendUp

- CashNetUSA

- Check ‘n Go

- PDL Loan

- 247Moneybox

- MyJar

- QuickQuid

- Ferratum Group

- LendingBear

The global payday loan market is segmented as follows:

By Type

- Storefront Payday Loans

- Online Payday Loans

By Marital Status

- Married

- Single

By Customer Age

- Less than 21

- 21-30

- 31-40

- 41-50

- More than 50

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Southeast Asia

- Rest of Southeast Asia

- The Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Request Free Brochure of the Global Payday Loan Market @ https://www.zionmarketresearch.com/requestbrochure/payday-loan-market

Key Questions Answered in This Report:

- What is payday loan?

- Which key factors will influence payday loan market growth over 2025-2034?

- What will be the value of the payday loan market during 2025-2034?

- What will be the CAGR value of the payday loan market during 2025-2034?

- Which region will contribute notably towards the payday loan market value?

- Which are the major players leveraging the payday loan market growth?

- What can be expected from the global payday loan market report?

Key Offerings:

- Full in-depth analysis of the parent market

- Important changes in market dynamics

- Segmentation details of the market

- Previous, ongoing, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional markets

- Testimonials to companies in order to fortify their foothold in the market

Browse Other Related Research Reports from Zion Market Research

- Extra Virgin Avocado Oil Market By Product Type (Solvent Extracted and Cold Pressed), By Distribution Channel (Specialty Stores, Online Stores, and Supermarkets & Hypermarkets), By Application (Food & Beverages, Cosmetics & Personal Care, and Pharmaceuticals), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

- School Supplies Market By Product Type (Backpacks & Bags, Office Supplies, Art Supplies, Stationery, Technology, and Miscellaneous), By Distribution Channel (Supermarkets & Hypermarkets, Specialty Stores, Online Retailers, and Stationery Stores), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

- Environmental Social Governance Investing Market By Type (ESG Integration, Impact Investing, Sustainable Funds, Green Bonds, and Others), By Investor Types (Institutional Investors, Retail Investors, Corporate Investors), By Application (Environmental, Social, Governance, Integrated ESG), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

- Plus Size Clothing Market By Product Type (Sportswear, Formal Wear, Casual Wear, and Others), By Consumer Orientation (Female and Male), By Sales Channel (Offline Stores and Online Portals), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

- Casino Hotels Market By Type (Poker, Blackjack, Roulette, Slots, and Others), By Consumer Orientation (Men, Women), By Age Group (18 to 35 Years, 36 to 50 Years, 50 Years and Above), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

- Scented Candles Market By Product Type (Container-Based Scented Candles, Pillar Scented Candles, Taper Scented Candles, Tea Light Scented Candles, and Others), By Wax Type (Paraffin Wax, Soy Wax, Beeswax, Palm Wax, Coconut Wax, Blended Wax, and Others), By Category (Mass, Premium), By Distribution Channel (Online, Offline), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

About Zion Market Research:

Zion Market Research is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Zion Market Research are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds.

Our clients’/customers’ conviction in our solutions and services has pushed us to always deliver the best. Our advanced research solutions have helped them in making appropriate decision-making and providing guidance for strategies to expand their business.

Contact Us:

Zion Market Research

USA/Canada Toll Free: 1 (855) 465-4651 | Newark: 1 (302) 444-0166

UK: +44 2032 894158

India: +91 7768 006 007 | +91 7768 006 008

Email: sales@zionmarketresearch.com | Web: https://www.zionmarketresearch.com/

Follow Us on - LinkedIn | X | Facebook | Pinterest | YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.